How to file a car insurance claim sets the stage for understanding a fundamental aspect of car ownership and financial security. Navigating the maze of insurance claims can be daunting, yet knowing the right steps can make the process much smoother. From gathering evidence at the scene of an accident to understanding the various types of claims, this guide will equip you with the necessary tools to tackle any car insurance claim with confidence.

Investigate the pros of accepting Ford Mustang Shelby GT350R in your business strategies.

In the following sections, we’ll break down the claims process, from preparation to communication with your insurance adjuster, ensuring you are well-informed and ready to handle your claim efficiently.

Learn about more about the process of Cheapest car insurance for young drivers in the field.

Overview of Car Insurance Claims

Filing a car insurance claim is an essential step in the aftermath of an accident or damage to your vehicle. The purpose of a claim is to seek compensation for losses incurred, ensuring that you do not bear the financial burden alone. Understanding the types of claims available and the claims process itself is crucial for a smooth experience.

Car insurance claims can generally be categorized into several types, including collision claims, comprehensive claims, liability claims, and uninsured/underinsured motorist claims. Each type serves a different purpose, addressing various circumstances that may arise from vehicle-related incidents. The claims process typically involves notifying your insurance company, providing necessary documentation, and working with an adjuster to assess and settle your claim.

Preparing to File a Claim

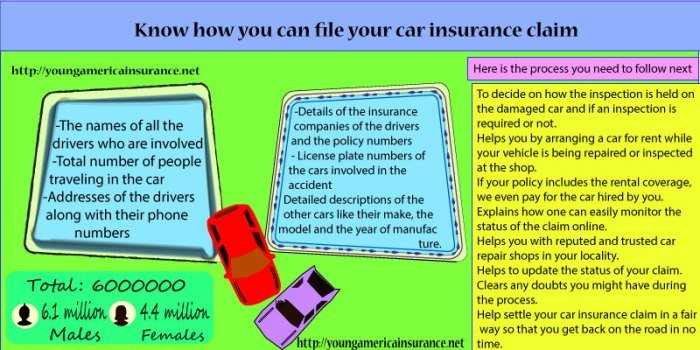

Before filing a claim, it is important to gather all necessary documents and information. This preparation helps streamline the process and ensures you have everything required to support your claim. Key documents include your insurance policy, details of the accident, photographs, and any witness statements.

At the scene of an accident, collecting evidence is vital. This includes taking photographs of the vehicles involved, the accident scene, and any relevant road signs or signals. Additionally, obtaining contact information from witnesses can provide crucial support for your claim, as their statements may corroborate your account of the incident.

Steps to File a Car Insurance Claim

Initiating a claim with an insurance provider involves specific steps. Firstly, notify your insurance company as soon as possible, providing them with details of the accident. Next, fill out the claim form accurately, ensuring all required information is included. This may involve providing details about the accident, involved parties, and any damages incurred.

Contacting the insurance company promptly is significant, as delays can result in complications or potential denial of your claim. Clear communication ensures that your insurer is aware of the situation and can guide you through the claims process effectively.

Communicating with the Insurance Adjuster

Preparing for a conversation with an insurance adjuster is essential for a successful claims experience. This preparation includes reviewing your claim details, understanding your policy coverage, and being ready to discuss the specifics of the incident. Clear communication is important for presenting your case effectively.

When explaining your claim, focus on key points such as the circumstances of the accident, the damages sustained, and any supporting evidence you have gathered. Be prepared to answer common questions from the adjuster, such as the details of the accident, your account of events, and any witness testimonies.

What to Expect After Filing a Claim

After submitting a claim, it is important to understand the typical timeline for the claims process. Generally, the insurer will review your claim and may conduct an investigation, which can take several days to weeks depending on the complexity of the case.

Possible outcomes of a claim vary and may include full approval, partial approval, or denial. Insurers determine outcomes based on the evidence provided, policy coverage, and liability assessment. If a claim is denied, information regarding the appeal process is available, allowing you to contest the decision if you believe it was unjust.

Tips for a Successful Claim Experience, How to file a car insurance claim

To enhance the likelihood of a successful claim experience, consider the following do’s and don’ts:

- Do: Keep thorough records of all communications with your insurance company.

- Do: Understand your policy details before filing a claim.

- Don’t: Delay in reporting the incident to your insurance provider.

- Don’t: Provide incomplete information on your claim form.

Keeping organized records and understanding your coverage can significantly impact the efficiency of your claim process.

Common Mistakes to Avoid

Filing a car insurance claim can be complex, and several frequent errors can hinder your success. Common mistakes include providing inaccurate information, failing to report the claim in a timely manner, and neglecting to document the incident thoroughly.

These mistakes can affect the outcome of your claim, potentially leading to delays or denials. To mitigate these risks, ensure that you double-check all information provided, maintain communication with your insurer, and document every aspect of the accident comprehensively.

Understanding State-Specific Regulations

Car insurance claim processes can vary significantly by state. Understanding these variations is crucial for ensuring compliance with local laws and regulations. Each state may have different requirements for filing claims, deadlines for reporting, and specific coverage mandates.

Resources for finding state-specific insurance regulations include your state’s insurance department website, consumer advocacy organizations, and legal resources. Being aware of local laws affecting claims can help you navigate the process more effectively.

Resources for Assistance

Several consumer advocacy organizations can assist individuals with insurance claims. These organizations offer guidance, support, and resources for understanding policies and navigating the claims process.

Online resources, such as state insurance department websites, can provide valuable information about filing claims and understanding your rights. For deeper insights, contact information for state insurance departments is often listed on their official sites, offering direct assistance for claim-related inquiries.

End of Discussion: How To File A Car Insurance Claim

In conclusion, successfully filing a car insurance claim hinges on preparation, clear communication, and understanding the processes involved. By following the Artikeld steps and avoiding common pitfalls, you can enhance your experience and improve your chances of a favorable outcome. Remember, being proactive and well-informed not only safeguards your interests but also empowers you to navigate the complexities of insurance with ease.