Car insurance rates by state are not just numbers; they reflect the unique driving conditions, regulations, and demographics of each region. Understanding these rates is crucial for consumers aiming to secure the best coverage at the most competitive prices. With a myriad of factors influencing premiums—from state laws and population density to local weather patterns and accident statistics—navigating this landscape can be daunting yet rewarding.

Discover the crucial elements that make Electric vs hybrid car performance the top choice.

This guide delves into the intricacies of car insurance rates across the United States, providing a state-by-state breakdown while highlighting the key elements that affect premiums. From identifying the states with the highest and lowest rates to exploring the impact of local regulations, this overview equips you with essential knowledge to make informed decisions.

Remember to click How to get low car insurance rates to understand more comprehensive aspects of the How to get low car insurance rates topic.

Overview of Car Insurance Rates

Understanding car insurance rates is crucial for consumers seeking to protect their vehicles and finances. Insurance premiums can vary significantly from state to state, influenced by a multitude of factors including local regulations, demographics, and environmental conditions. Knowing these rates helps drivers make informed decisions and potentially save money on their premiums.

Several key factors affect car insurance premiums across different states. These include the level of coverage required by state law, the population density in urban versus rural areas, and the frequency of car accidents. Additionally, state regulations play a significant role in determining the cost of insurance. Different states have varying insurance laws that can lead to substantial differences in premiums.

State-by-State Breakdown, Car insurance rates by state

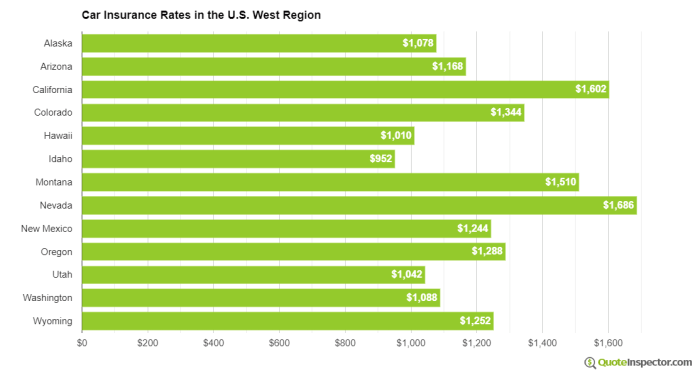

A detailed analysis of car insurance rates reveals wide discrepancies across the United States. The following table illustrates average car insurance rates by state, including minimum and maximum coverage options.

| State | Average Rate | Minimum Coverage | Maximum Coverage |

|---|---|---|---|

| Michigan | $2,394 | $50,000 | $500,000 |

| California | $1,200 | $15,000 | $1,000,000 |

| Texas | $1,800 | $30,000 | $1,000,000 |

| Vermont | $900 | $25,000 | $500,000 |

The highest car insurance rates can be found in Michigan, while Vermont boasts the lowest. Over recent years, states like Florida and New York have seen significant fluctuations in their insurance rates, driven by changes in legislation and accident statistics.

Factors Affecting Rates by State

Population density is a significant factor influencing car insurance rates, with urban areas typically facing higher premiums due to increased traffic and accident rates. Conversely, rural areas often have lower rates due to fewer vehicles on the road and less congestion.

Local weather conditions also impact premiums, with states prone to severe weather events, such as hurricanes or snowstorms, experiencing higher rates. For instance, states like Florida and Louisiana, which are frequently affected by hurricanes, may have elevated insurance costs.

Accident rates vary by state and significantly affect insurance pricing. States with higher accident statistics generally impose higher premiums to cover potential claims, leading to increased financial burdens for drivers in those regions.

State Regulations and Laws

Different state laws, such as no-fault insurance policies, can greatly influence insurance rates. No-fault insurance requires drivers to carry specific coverage levels, often resulting in higher premiums. Additionally, state insurance commissioners play a vital role in regulating these rates, ensuring that they reflect the risk levels within their jurisdictions.

Some states have unique insurance laws that directly affect rates. For example, Massachusetts employs a managed competition model, which can keep premiums relatively lower compared to states without such regulations.

Tips for Finding Competitive Rates

Finding the best car insurance rates requires strategic planning and research. Here are some effective strategies consumers can utilize:

- Compare multiple quotes from different insurance providers to identify competitive rates.

- Consider adjusting coverage levels and deductibles to match your financial situation and comfort level.

- Check for discounts offered by insurers, such as safe driver discounts or multi-policy savings.

- Maintain a good driving record, as this significantly impacts premium costs.

A step-by-step guide to comparing quotes involves gathering information from various insurers, assessing similar coverage levels, and reviewing customer feedback to ensure the chosen provider meets your needs.

Additional Considerations

Credit scores can also play a crucial role in determining car insurance rates. Many states allow insurers to use credit history as a factor in pricing policies, with better credit scores often resulting in lower premiums.

Demographic trends show that age and gender can affect insurance costs, with younger drivers typically paying higher rates due to inexperience. However, advancements in technology, such as telematics, are increasingly shaping insurance pricing models, allowing insurers to offer personalized rates based on actual driving behaviors.

Resources for Consumers

There are several reputable resources available for consumers to research car insurance rates by state. Websites such as the National Association of Insurance Commissioners (NAIC) and state-specific insurance departments can provide valuable information.

Consulting with licensed insurance agents can offer personalized insights that online platforms may not provide. Understanding the details and jargon found in insurance policies is essential for making informed decisions, so consumers should take the time to familiarize themselves with common terms and coverage options.

Wrap-Up: Car Insurance Rates By State

In conclusion, understanding car insurance rates by state empowers consumers to navigate their options effectively. By recognizing the various factors that influence these rates, from regulatory differences to demographic trends, individuals can better position themselves to find optimal coverage for their needs. Armed with this knowledge, you can confidently explore the best strategies for securing competitive car insurance rates tailored to your location.